Kenya’S New Payment Revolution

Big changes are coming to Kenya’s digital finance scene! The Central Bank of Kenya (CBK) is fast-tracking a groundbreaking mobile payment system designed to rival Safaricom’s M-Pesa, the current king of mobile money. This bold initiative aims to shake up the market with a faster, more versatile system that puts power and flexibility into the hands of everyday Kenyans.

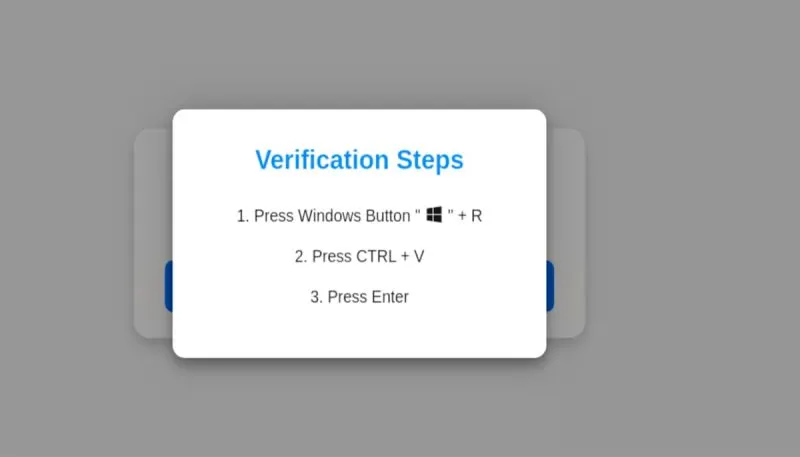

This isn’t just about competition; it’s about interoperability. The new payment system promises to work seamlessly across various platforms, giving users the freedom to send and receive money without being tethered to one provider. Think of it as the financial equivalent of opening all the gates in a walled garden—everyone is invited!

The National Treasury has revealed that this bold move aligns with the ongoing National Payment Strategy (2022-2025). In fact, plans are already in motion to finalise the much-anticipated National Policy on Digital Finance, a blueprint for a more inclusive and efficient digital economy.

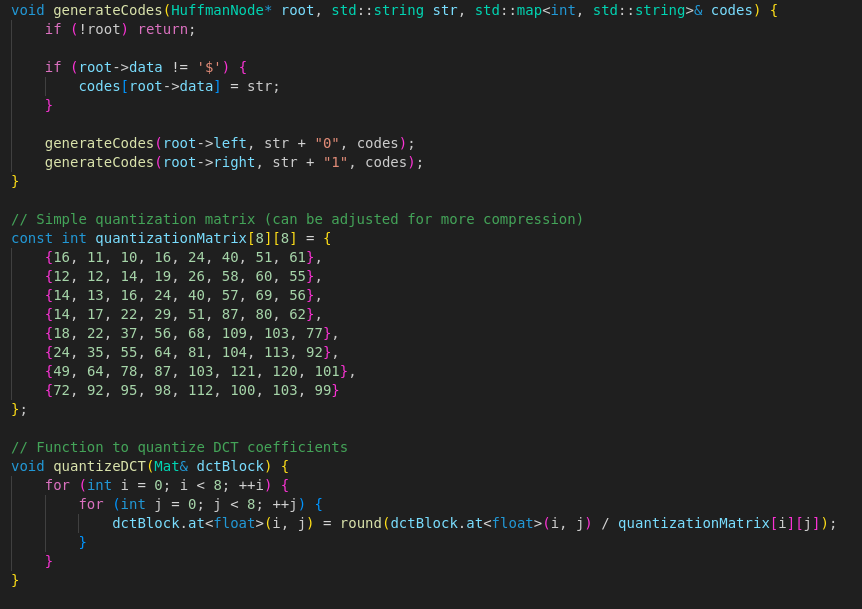

Kenya has already seen substantial upgrades in its payment landscape. From the establishment of a robust national payment infrastructure to automating key systems, the foundation is strong. But CBK isn’t stopping there; this new initiative aims to turbocharge innovation and break M-Pesa’s monopoly.

Whether it’s paying at the market or sending school fees, Kenyans are about to get a new, high-speed, user-friendly option. And with a smartphone in nearly every hand, the possibilities are endless.

Is this the dawn of the next big thing in mobile money? Stay tuned!

Comments