The Dark Side Of Trump And Melania Meme Coins: A Case Of Pump And Dump Fear

Meme coins have always been a volatile corner of the cryptocurrency market, often driven by speculation, hype, and the allure of quick profits. However, the launch of Trump and Melania meme coins, just hours before Donald Trump’s inauguration, exposed the darker side of this phenomenon. What initially appeared to be a bold move in the crypto space quickly unraveled into a cautionary tale of manipulation and fear.

The Launch and Immediate Hype

The timing of the Trump and Melania meme coin launches was no coincidence. Released just before Donald Trump’s inauguration, the coins capitalized on the global attention surrounding the event. Marketing campaigns hinted at their connection to Trump’s legacy, drawing in investors eager to associate themselves with the former president’s brand.

The initial supply of TrumpCoin was staggering—500 million coins were sold, creating a buzz that suggested strong demand. However, the excitement masked deeper issues that would soon surface.

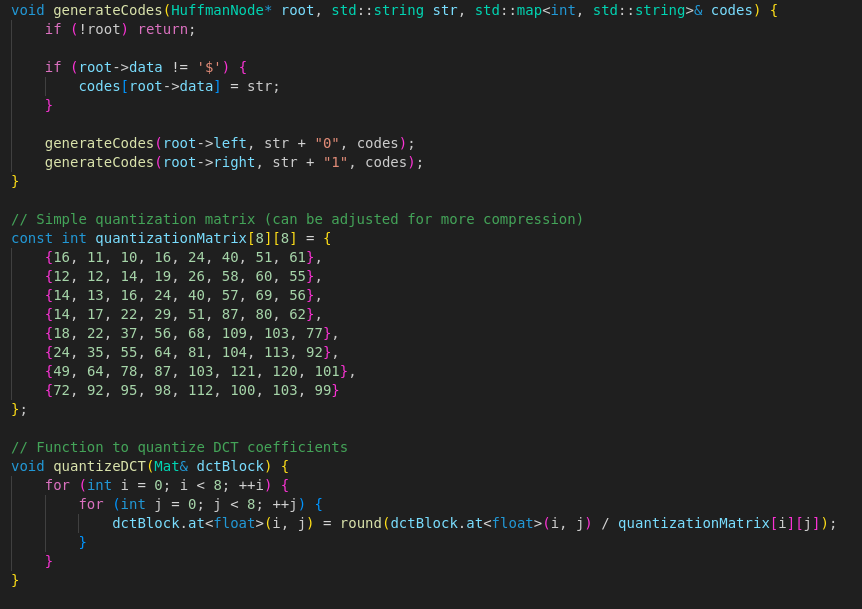

Unearthing the Supply Discrepancies

Despite the maximum supply being set at 999 million coins, only 200 million coins remained in circulation after the initial sale. This discrepancy raised eyebrows, suggesting the possibility of hidden agendas and manipulation. A closer look at the Phantom wallet holdings revealed a startling discovery: the top ten holders controlled approximately 86% of the total supply.

Such concentrated ownership in any cryptocurrency is a red flag, as it indicates the potential for a few individuals to manipulate the market. In this case, it heightened fears of a classic pump-and-dump scheme, where prices are artificially inflated before the major holders sell off their assets, causing a market crash.

The Fear of Massive Selling Pressure

With only 200 million coins circulating and the majority of the supply concentrated in a handful of wallets, the market faced the looming threat of massive selling pressure. If these top holders decided to liquidate their positions, the price of TrumpCoin would plummet, leaving smaller investors to bear the brunt of the losses.

The situation was further complicated by the lack of transparency surrounding the coins. Investors had little information about the project’s roadmap, utility, or the identities of the major holders, all of which are critical for assessing the long-term viability of a cryptocurrency.

Lessons from the TrumpCoin Debacle

The Trump and Melania meme coin saga serves as a stark reminder of the risks inherent in speculative investments. Here are some key takeaways:

-

Beware of Concentrated Ownership: Coins with a majority of supply held by a few wallets are prone to manipulation and sudden price crashes.

-

Demand Transparency: Investors should prioritize projects with clear roadmaps, transparent teams, and decentralized ownership structures.

-

Understand the Hype: While meme coins thrive on viral appeal, it’s essential to separate genuine opportunities from short-term speculation.

Conclusion

The Trump and Melania meme coins may have launched with fanfare, but their trajectory highlighted the pitfalls of hype-driven investments. As the crypto market continues to evolve, it’s crucial for investors to approach such projects with caution, armed with thorough research and an understanding of the risks involved.

While meme coins can be fun and potentially lucrative, the TrumpCoin debacle underscores the importance of vigilance in a market where not everything is as it seems.

Comments